Photo by Stephen Phillips on Hostreviews.co.uk

Credit Card Cashback

When deciding what type of credit card to apply for, one of the decisions you will need to make is whether or not there is an annual fee. Why choose an annual fee credit card? The answer may seem obvious, why would anyone choose to pay a yearly fee compared to no fee? Credit cards that come with an annual fee, typically offer bonuses and rewards that depending on your spending may end up being worth more than the annual fee.

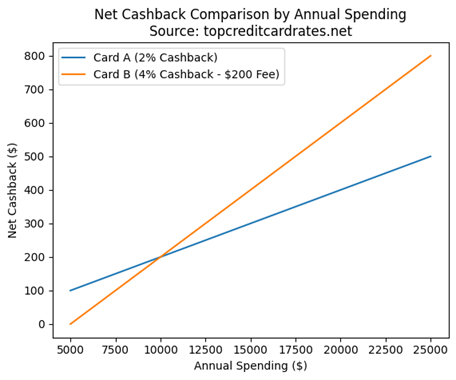

Some credit card companies will offer cashback on spending and may offer a higher percentage rate on the card that applies an annual fee. For example, Credit Card A offers no annual fee and offers a 2% cashback on all spending at the supermarket. Credit Card B has an annual fee of $200 but offers cashback of 4% at the supermarket. Which credit card you will decide to apply for will depend on your spending. If you are likely to spend more than $5000 at the supermarket, then the 4% cashback will cancel out the annual fee as 4% of $5000 is equal to the annual fee of $200, and any further purchases will provide extra cashback. Alternatively, if you spend $6000 at the supermarket, Card A, without annual fee, will give you a cashback of $120. Card B will give you a cashback reward of $240 – $200 annual fee equals $40 cash back. Therefore, the more you spend on the card with the annual fee, the cashback value you will receive.

Some credit card companies will offer cashback on spending and may offer a higher percentage rate on the card that applies an annual fee. For example, Credit Card A offers no annual fee and offers a 2% cashback on all spending at the supermarket. Credit Card B has an annual fee of $200 but offers cashback of 4% at the supermarket. Which credit card you will decide to apply for will depend on your spending. If you are likely to spend more than $5000 at the supermarket, then the 4% cashback will cancel out the annual fee as 4% of $5000 is equal to the annual fee of $200, and any further purchases will provide extra cashback. Alternatively, if you spend $6000 at the supermarket, Card A, without annual fee, will give you a cashback of $120. Card B will give you a cashback reward of $240 – $200 annual fee equals $40 cash back. Therefore, the more you spend on the card with the annual fee, the cashback value you will receive.